What Is Taxable Fringe . For example, an employee has a taxable. Web the taxable amount of a benefit is reduced by any amount paid by or for the employee. How are fringe benefits taxed in singapore? Web what is a fringe benefit? Employers can provide their employees with a variety of desirable. A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to. Fringe benefits are goods and services that are given to employees for. Web reimbursement for an item that has not been granted concession or exempt from tax is taxable. These benefits are given to employees. Web generally, fringe benefits with significant value are considered taxable to the employee and subject to federal withholding,. Web what are taxable fringe benefits?

from www.studocu.com

Employers can provide their employees with a variety of desirable. Web reimbursement for an item that has not been granted concession or exempt from tax is taxable. For example, an employee has a taxable. These benefits are given to employees. Web generally, fringe benefits with significant value are considered taxable to the employee and subject to federal withholding,. Web what is a fringe benefit? Web what are taxable fringe benefits? Web the taxable amount of a benefit is reduced by any amount paid by or for the employee. Fringe benefits are goods and services that are given to employees for. How are fringe benefits taxed in singapore?

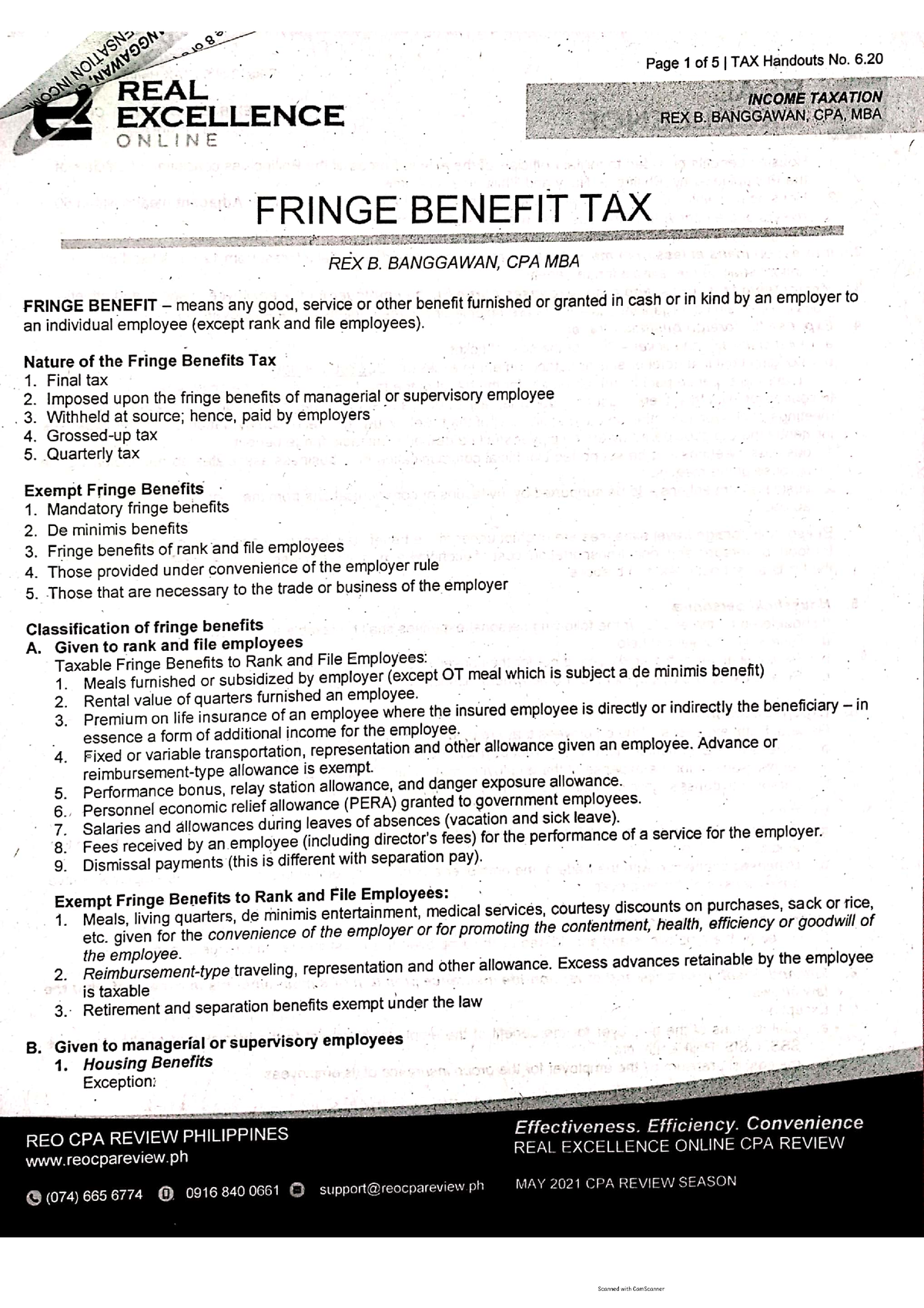

REO Taxation FringeBenefitTax Financial Accounting Studocu

What Is Taxable Fringe Fringe benefits are goods and services that are given to employees for. Web reimbursement for an item that has not been granted concession or exempt from tax is taxable. How are fringe benefits taxed in singapore? Web what are taxable fringe benefits? Web what is a fringe benefit? These benefits are given to employees. Web the taxable amount of a benefit is reduced by any amount paid by or for the employee. A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to. Employers can provide their employees with a variety of desirable. For example, an employee has a taxable. Fringe benefits are goods and services that are given to employees for. Web generally, fringe benefits with significant value are considered taxable to the employee and subject to federal withholding,.

From what-benefits.com

Are Fringe Benefits Taxable What Is Taxable Fringe Web the taxable amount of a benefit is reduced by any amount paid by or for the employee. These benefits are given to employees. For example, an employee has a taxable. Web reimbursement for an item that has not been granted concession or exempt from tax is taxable. Employers can provide their employees with a variety of desirable. Web what. What Is Taxable Fringe.

From studylib.net

AP Taxable vs Non Taxable Fringe Benefits What Is Taxable Fringe These benefits are given to employees. Fringe benefits are goods and services that are given to employees for. Employers can provide their employees with a variety of desirable. Web generally, fringe benefits with significant value are considered taxable to the employee and subject to federal withholding,. How are fringe benefits taxed in singapore? Web reimbursement for an item that has. What Is Taxable Fringe.

From www.slideserve.com

PPT TxEIS 2013 w2 checklist PowerPoint Presentation, free download What Is Taxable Fringe For example, an employee has a taxable. How are fringe benefits taxed in singapore? A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to. Employers can provide their employees with a variety of desirable. Web the taxable amount of a benefit is reduced by any amount paid by or for the employee.. What Is Taxable Fringe.

From www.hourly.io

Taxable vs Nontaxable Fringe Benefits Hourly, Inc. What Is Taxable Fringe Web the taxable amount of a benefit is reduced by any amount paid by or for the employee. Web reimbursement for an item that has not been granted concession or exempt from tax is taxable. For example, an employee has a taxable. Web what are taxable fringe benefits? Employers can provide their employees with a variety of desirable. A fringe. What Is Taxable Fringe.

From www.studocu.com

Module 11 Fringe Benefit Tax FRINGE BENEFIT TAX Module No. 11 What Is Taxable Fringe Fringe benefits are goods and services that are given to employees for. Web generally, fringe benefits with significant value are considered taxable to the employee and subject to federal withholding,. Web what are taxable fringe benefits? How are fringe benefits taxed in singapore? For example, an employee has a taxable. Employers can provide their employees with a variety of desirable.. What Is Taxable Fringe.

From studylib.net

Taxable Fringe Benefit Guide What Is Taxable Fringe For example, an employee has a taxable. Web the taxable amount of a benefit is reduced by any amount paid by or for the employee. A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to. Employers can provide their employees with a variety of desirable. Web generally, fringe benefits with significant value. What Is Taxable Fringe.

From what-benefits.com

What Are Taxable Fringe Benefits What Is Taxable Fringe Employers can provide their employees with a variety of desirable. For example, an employee has a taxable. Web generally, fringe benefits with significant value are considered taxable to the employee and subject to federal withholding,. Web reimbursement for an item that has not been granted concession or exempt from tax is taxable. A fringe benefit is a form of pay. What Is Taxable Fringe.

From smartworkpapershelp.hownowhq.com

Fringe Benefits Tax Smart Workpapers Help & Support What Is Taxable Fringe A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to. Web reimbursement for an item that has not been granted concession or exempt from tax is taxable. Web what is a fringe benefit? How are fringe benefits taxed in singapore? Web what are taxable fringe benefits? For example, an employee has a. What Is Taxable Fringe.

From www.slideserve.com

PPT AP and PR Taxable vs Non Taxable Fringe Benefits PowerPoint What Is Taxable Fringe For example, an employee has a taxable. A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to. Employers can provide their employees with a variety of desirable. Web generally, fringe benefits with significant value are considered taxable to the employee and subject to federal withholding,. Web the taxable amount of a benefit. What Is Taxable Fringe.

From www.slideserve.com

PPT OSPS YearEnd Training Taxable Fringe Benefits and Tax Forms What Is Taxable Fringe For example, an employee has a taxable. Web the taxable amount of a benefit is reduced by any amount paid by or for the employee. Web what is a fringe benefit? Web generally, fringe benefits with significant value are considered taxable to the employee and subject to federal withholding,. Web what are taxable fringe benefits? How are fringe benefits taxed. What Is Taxable Fringe.

From www.chegg.com

Solved A taxable fringe benefit in respect of residential What Is Taxable Fringe Fringe benefits are goods and services that are given to employees for. Web what is a fringe benefit? Web generally, fringe benefits with significant value are considered taxable to the employee and subject to federal withholding,. Web what are taxable fringe benefits? These benefits are given to employees. Web reimbursement for an item that has not been granted concession or. What Is Taxable Fringe.

From www.slideshare.net

Taxable Fringe Benefits What Is Taxable Fringe Employers can provide their employees with a variety of desirable. Web reimbursement for an item that has not been granted concession or exempt from tax is taxable. These benefits are given to employees. Web what is a fringe benefit? Web what are taxable fringe benefits? Fringe benefits are goods and services that are given to employees for. A fringe benefit. What Is Taxable Fringe.

From www.shiftbase.com

Unlocking the Potential of TaxFree Fringe Benefits A Comprehensive What Is Taxable Fringe These benefits are given to employees. Web what is a fringe benefit? Web generally, fringe benefits with significant value are considered taxable to the employee and subject to federal withholding,. For example, an employee has a taxable. Employers can provide their employees with a variety of desirable. Fringe benefits are goods and services that are given to employees for. How. What Is Taxable Fringe.

From desklib.com

Taxation Law Fringe Benefit and Taxable Value Calculation What Is Taxable Fringe Web the taxable amount of a benefit is reduced by any amount paid by or for the employee. How are fringe benefits taxed in singapore? Web generally, fringe benefits with significant value are considered taxable to the employee and subject to federal withholding,. For example, an employee has a taxable. A fringe benefit is a form of pay (including property,. What Is Taxable Fringe.

From www.studocu.com

LU 5 fringe benefits Summary Principles of Taxation LU 5 FRINGE What Is Taxable Fringe Employers can provide their employees with a variety of desirable. Fringe benefits are goods and services that are given to employees for. A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to. How are fringe benefits taxed in singapore? Web the taxable amount of a benefit is reduced by any amount paid. What Is Taxable Fringe.

From www.slideserve.com

PPT Fringe Benefits PowerPoint Presentation, free download ID1404351 What Is Taxable Fringe These benefits are given to employees. A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to. For example, an employee has a taxable. Web what is a fringe benefit? Web generally, fringe benefits with significant value are considered taxable to the employee and subject to federal withholding,. Employers can provide their employees. What Is Taxable Fringe.

From aghuniversity.com

Fringe benefits reporting & taxation What employers should know What Is Taxable Fringe Web the taxable amount of a benefit is reduced by any amount paid by or for the employee. These benefits are given to employees. A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to. Web generally, fringe benefits with significant value are considered taxable to the employee and subject to federal withholding,.. What Is Taxable Fringe.

From www.thehrdigest.com

What Are Fringe Benefits and Are They Taxable? What Is Taxable Fringe These benefits are given to employees. Web reimbursement for an item that has not been granted concession or exempt from tax is taxable. How are fringe benefits taxed in singapore? Employers can provide their employees with a variety of desirable. Web what is a fringe benefit? Web generally, fringe benefits with significant value are considered taxable to the employee and. What Is Taxable Fringe.